Release Notes

End of support for Microsoft Office 2013 and Microsoft Internet Explorer 11

As we have been announcing since May 2021, in particular in an article of our Knowledge Base as well as the e-mails sent last May, starting in November 2021, Wolters Kluwer will discontinue support for Microsoft Office 2013 and Microsoft Internet Explorer 11.

For more information, consult our Knowledge Base article End of support for Microsoft Office 2013 and Internet Explorer 11. An upgrade of your system may be required.

End of support for Windows 32-bit versions

As announced in the Windows 10 version 2004 system requirements, Microsoft stopped releasing 32-bit versions of operating systems. Therefore, please note that the versions of our software, which will be released in December 2022, will have a 64-bit architecture, and will no longer support 32-bit operating systems. Therefore, Taxprep will no longer operate on 32-bit operating systems.

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About

This version contains most of the forms released by the Canada Revenue Agency (CRA) and Revenu Québec (RQ) for the 2021 taxation year. These forms were approved by the tax authorities and allow you to file income tax returns for taxpayers who do not require the forms listed in the “Calculations and Forms Not Available or Under Review” section.

This version of Personal Taxprep was updated in order to integrate the most recent tax measures pursuant to the 2021 taxation year. This version is approved for:

- Paper filing;

- EFILE;

- Electronic filing of Form AUTHORIZATION;

- Electronic filing of Form T1135;

- Using the Auto-fill T1 return (AFR) service (TaxprepConnect functionality);

- The ReFILE service;

- The PAD (Pre-authorized debit);

- The Express NOA (Notice of Assessment);

- Printing the 2D bar code on the federal and Québec returns;

- Electronic filing via NetFile Québec.

Training

To consult the different training options available regarding Personal Taxprep (seminars, webinars, tutorials and more), access the Training section of the Wolters Kluwer Web site. You can also access it from the program, by selecting Get Taxprep Training in the Help menu.

For Taxprep training, please contact the Professional Services team at learning@wolterskluwer.com.

Convert Preparer Profiles, Client Letters Templates, Print Formats, Filters and Diagnostics

In a new taxation year, remember that the preparer profiles, client letter templates, print formats, filters and diagnostics from the prior period must be converted.

Templates can be converted using the Convert function which is available in each template view. A File/Open dialog box will appear, and the folder opened will be the default location of the prior version template. Select an alternative folder if your prior version template is not in that location. Select all of the templates that you wish to convert.

Once your preparer profiles from last year are converted to the current year, it is important to verify that the options defined with respect to the returns of your clients and to the electronic filing of data (EFILE) still correspond to your situation for the current season. For more information on the new options offered in the preparer profiles of the current version, please refer to the “Modifications Made to Forms” section.

TaxprepConnect for the 2021 tax season

Important dates

Federal

February 7, 2022 – Opening of the Auto-fill T1 return service. The CRA tax data can be downloaded using TaxprepConnect commencing with version 2.0 of Personal Taxprep 2021.

What’s new:

- T5013 slips can now be downloaded. However, the CRA only makes the following boxes available:

- box 002 – Partner code;

- box 003 – Country code;

- box 004 – Recipient type;

- box 005 – Partner’s share (%) of partnership;

- box 010 – Total limited partner’s business income (loss);

- box 020 – Total business income (loss);

- box 030 – Total capital gains (losses);

- box 040 – Capital cost allowance.

Unfortunately, this information is not sufficient to correctly complete the taxpayer’s return. Therefore, you have to check for missing information on the hard copy of the T5013 slip.

- The CRA increased the quantity of data that can be downloaded with respect to the Home Buyers' Plan (HBP) and the Lifelong Learning Plan (LLP) so that the downloaded information might mirror the presentation found on the My account and Represent a client Web pages.

- In addition, the following information can now be downloaded when available:

- the amounts in boxes 201, 205, 210 and 211 of the T4A slip;

- the Canada training credit limit;

- a new indicator for employment insurance for self-employed workers.

Québec

February 21, 2022 – Opening of the Tax Data Download service. The Revenu Québec tax data can be downloaded using TaxprepConnect commencing with version 2.0 of Personal Taxprep 2021.

What’s new:

The amount in the following new boxes can now be downloaded when available:

- boxes RY, O-8, O-9 and O-10 of the RL-1 slip;

- boxes G1, G2, H1, H2, J1 and J2 of the RL-10 slip;

- box H of the RL-19 slip.

Auto-fill T1 return – Download prior-year data

You can download tax data from the previous five years (2016, 2017, 2018, 2019 and 2020). To download data of a given year, you will have to use the Personal Taxprep program of the year in question.

Note that only data on slips of prior years will be available; data that does not relate to a specific year, such as carried forward balances, will not be available.

Tax Data Download of Revenu Québec – Download prior-year data

You can download tax data from the three previous years (2018, 2019 and 2020). To download data for a given year, you must use the version of Personal Taxprep of the year in question and have a valid Form MR-69 with Revenu Québec.

Modifications Made to Version 2.0

FORMS, SCHEDULES AND WORKCHARTS ADDED TO THE PROGRAM

Federal

T2043, Return of Fuel Charge Proceeds to Farmers Tax Credit (Jump Code: 2043)

Beginning in the 2021-2022 year, the Government of Canada introduced a refundable tax credit, i.e., the Return of Fuel Charge Proceeds to Farmers Tax Credit. This credit is intended to return a portion of the fuel charge proceeds from the federal carbon pollution pricing system directly to farming businesses in provinces that do not currently meet the federal stringency requirements.

These designated provinces are Ontario, Manitoba, Saskatchewan, and Alberta. Eligible farming businesses include self-employed farmers, partnerships and partners in farming partnerships that actively engage in either the management or daily activities related to the earning of income from farming and incur total farming expenses of $25,000 or more, which are all or partially allocated to designated provinces.

As a result, Form T2043 has been added to calculate the return of fuel charge proceeds to farmers tax credit. In addition, Form T2043 WS has been added to facilitate calculations in Parts A, B and C. The worksheets will be automatically linked to a statement (T2042, T1163 or T1273). Form T2043 cumulates all worksheets T2043 WS. Note that this refundable tax credit is claimed on line 47556 of the T1 return.

The credit is considered government assistance received during the year and is taxable. It should be included in the return for the taxation year in which it was claimed, not in the year in which it is received.

If the statement of income and expenses (Form T2042, T1163 or T1273) already exists, depending on the type of statements of income and expenses, this refundable tax credit is automatically included in income on:

- line 9600 of Form T2042;

- line 9959 of Form T1163;

- line 9959 of Form T1273.

However, should the taxpayer be a member of a partnership the credit will be prorated on Form T2043 and considered as the partner’s and will be updated to line 5B in Part 5 of Form T2042 or to line E of Form T1163 or T1273.

If the partner receives a T5013 slip in which an amount is shown in box 237:

For partners, the amount of this credit is entered in box 237 of the issued T5013 slip. The amount from this box is automatically transferred to Form T2043 and included as farming income. If the farming income on the T5013 slip is transferred to a statement of farming income for purposes of deducting the partner’s personal expenses, the amount in box 237 will be automatically updated to line 5B of Part 5 in the appropriate copy of Form T2042. If the taxpayer participates in the AgriStability and AgriInvest programs, the amount in box 237 will have to be manually included on line E of Forms T1163 or T1273 respectively.

If the partner receives a letter indicating the amount of the tax credit:

Where the partner received a letter indicating the refundable tax credit amount and where no T5013 slip was filed, manually enter the credit amount on line 67077 in Part 5 of Form T2043. In addition, this amount must be manually entered as personal income on line 5B of Part 5 in the appropriate copy of Form T2042. If the taxpayer participates in the AgriStability and AgriInvest programs, include the amount on line E of Forms T1163 or T1273 respectively.

Modifications Made to Forms

Preparer Profiles

EFILE tab

- The box using an electronic signature method on Form RC71 for all or some taxpayers has been added to the preparer profiles in the Discounter default information section.

Federal

Schedule 3, Summary of Dispositions – Capital Gains (or losses) (Jump Code: 3) – Impact of rules relating to the eligible transfer of a family business as the result of Bill C-208.

As a result of the changes made to s. 84.1 of the Income Tax Act by Bill C-208, an eligible disposition of qualified small business corporation shares and shares of the capital stock of a family farm or fishing corporation by an individual to a corporation that is controlled by one or more of the individual’s children or grandchildren who are 18 years of age or older will be deemed to be a non arm’s length transaction for dispositions after June 28, 2021. As a result, the transaction will not be subject to the deemed dividend rules in s. 84.1 and for federal purposes, such a transaction should be treated in the same manner as a disposition of such property to an arm’s length party and entered on Schedule 3 accordingly.

However, for Québec purposes, the transaction will still be treated as non-arm’s length, although a portion of what would otherwise have been a deemed dividend may be deemed to be a capital gain on Form TP-517.5.5. A check box has been added to Part 1 and 2 of Schedule 3 to identify these transactions for Québec purposes and when this check box is selected, a diagnostic will remind the preparer to complete Form TP-517.5.5.

Benefit – Climate Action Incentive (Jump Code: GST)

The climate action incentive payment amounts are paid to residents of Ontario, Manitoba, Saskatchewan and Alberta, because these provinces do not have a pollution pricing system of their own. This is part of the federal government backstop, which ensures there is a consistent price on pollution across Canada and that approximately 90 per cent of proceeds go directly to Canadians. Families in rural and small communities receive an extra 10%.

Starting in July 2022, these payments will shift to quarterly amounts paid through the benefit system.

Details on these payments are available in the program, on Form GSTC.

Client letters:

Client letters have been adjusted to include the climate action incentive payment amounts.

RC71, Statement of Discounting Transaction (Jump Code: RC71)

Please note that the Canada Revenue Agency will not accept an RC71 form with an electronic signature until legislation is tabled and Royal Assent is received. Error 138 will be returned by the CRA if the electronic signature is used before Royal Assent has been received. The program has been updated in advance to allow you to use the electronic signature as soon as Royal Assent is received.

Electronic signature: Similar to what was introduced last year for Form T183, the CRA added three new EFILE fields, i.e., Electronic signature indicator, Signature date, and Signature time. Data in all of these fields must be transmitted when Form RC71 is electronically signed.

These fields can be found in the new Electronic Signature section, which was added to Form RC71, on screen only. When the answer to the question Are you planning on using an electronic signature method on Form RC71? is Yes and the return is discounted, EFILE diagnostics will prompt you to complete these fields to transmit the return.

When an electronic signature date is indicated, the signature date will automatically update to the existing field 65090. Both the new electronic signature date field and existing field 65090 are electronically transmitted to the CRA.

If you are a discounter and do not plan on using electronic signatures, you can clear the check box using an electronic signature method on Form RC71 for all or some taxpayers in the EFILE tab of the preparer profile in the Discounter default information section.

Doing so will prevent EFILE diagnostics related to the electronic signature on Form RC71 from being displayed.

T777S - Statement of Employment Expenses for Working at Home Due to COVID-19 (Jump Code: 777)

For the 2021 taxation year, the maximum of home office expenses has increased from $400 to $500 with the temporary flat rate method.

T2222, Northern Residents Deductions (Jump Code: 2222)

In its 2021 Budget, the federal government proposed to expand access to the travel component of the Northern Residents Deductions for the 2021 taxation year. Under the component, a taxpayer would have the option to claim, in respect of each of the taxpayer and each “eligible family member,” up to:

- the amount of employer-provided travel benefits the taxpayer received in respect of travel by that individual; or

- a $1,200 standard amount that may be allocated across eligible trips taken by that individual.

The same amendments have been made to Form TP-350.1 (Jump Code: Q350.1) for the residents of Québec.

Québec

TP1, Line 18 – Addition of code 08, Refugee protection claimant (Jump Code: QRESIDENCE).

To identify the status of individuals who are claiming certain credit for which they are not eligible, code 08, Refugee protection claimant, has been added to line 18 of the TP1 return.

This code can be selected in the program from the drop-down list of Form Residence QC.

TP-59S - Statement of Employment Expenses for Working at Home Due to COVID-19 (Jump Code: Q59)

For the 2021 taxation year, the maximum of home office expenses has increased from $400 to $500 with the temporary flat rate method.

Newfoundland and Labrador

NL428, Newfoundland and Labrador Tax (Jump Code: NL 428)

In its 2021 Budget, the Government of Newfoundland and Labrador proposed to add three new 2022 tax brackets for income in excess of $250,000, $500,000, and $1,000,000, for a total of eight brackets. The latter has been integrated to this version of the program but only for the Planner Mode or for early-filed returns.

Corrected Calculations

The following problems have been corrected in version 2021 2.0:

Federal

Electronic Filing

What’s New:

Starting in February 2022, the CRA will allow for Canadian residents and factual residents returns to be EFILED with a non-Canadian mailing address.

EFILING T1 returns with a non-Canadian mailing address

For the 2021 and subsequent tax years, the EFILE service will accept T1 income tax returns with a non-Canadian mailing address for Canadian residents and factual residents. A new section, i.e., EFILE: non-Canadian mailing address, is displayed on the ID form when a foreign country is entered in the mailing address. In this section, indicate whether the taxpayer is a Canadian resident or a factual resident for EFILE purposes. Please note that non-resident returns remain an exclusion from EFILE. Only returns with a Canadian province of residence (taxing province) can be EFILED with a non-Canadian mailing address.

When a non-Canadian mailing address is entered in the return and an amount is entered in box 24, Foreign business income, of the T3 slip, you will be prompted to enter a Canadian postal code if you want to EFILE the return. Enter the taxpayer’s Canadian postal code in the ID form even though the mailing address is outside Canada. In this situation, the postal code will only be used to process the SFD form associated with the T3 slips as required by the CRA—it will not be used in the mailing address.

Information about EFILE

Federal

Important dates

- February 7, 2022 – Opening of the system for electronic transmission of authorization requests.

- February 21, 2022 Opening of the EFILE On-Line transmission system.

- January 27, 2023 The CRA will stop accepting electronically filed T1 returns.

Registration and Renewal On-line

To renew your EFILE privileges for this year’s tax season, you must follow the instructions provided on the "Renewal" page on the CRA Web site at https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/efile-electronic-filers/yearly-renewal.html.

To register as a new electronic filer, you must register online by completing the EFILE Registration On-Line form on the CRA Web site at https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/efile-electronic-filers/yearly-renewal.html.

You will find more information concerning renewals and new applications at http://www.efile.cra.gc.ca/.

In order to be able to electronically file Form AUTHORIZATION, you must meet the following two criteria:

- Have a valid EFILE number and password; and

- Be a registered representative (online access).

A registered representative is a person who is registered with the CRA’s Represent a Client service. To register with the service, go to https://www.canada.ca/en/revenue-agency/services/e-services/represent-a-client.html

Québec

What’s New:

The electronic transmission of the MR-69 form is now available in version 2021.2.0. As opposed to the federal authorization transmission, which does not require proof of signature with the electronic transmission, Revenu Québec requires that a PDF of all three pages of the signed Form MR-69 be transmitted along with the authorization request.

In addition, where the person signing the authorization is not the taxpayer (e.g., in the case of a deceased taxpayer), Revenu Québec will require documentation to substantiate the authority of the signatory to provide authorization. In that case, an additional document should also be attached to the client file for transmission with the MR-69. As Revenu Québec will only accept a single supporting document in addition to the signed MR-69, all supporting documents should be merged into a single PDF, JPEG or TIFF file.

A maximum of two documents can be attached to the client file and filed with the transmission.

A 2-step checklist has been added to the form to help you prepare and electronically transmit an MR-69 form. By providing an answer to all statements in the checklist, you are making sure that the mandate is compliant and meets the requirements of Revenu Québec. This will prevent you from being prompted by an error code at the time of transmission.

The first step helps you complete the form correctly before printing it, so that the printed copy meets the requirements of Revenu Québec and contains a 2D bar code when the copy is signed by the taxpayer or representative.

The second step covers the requirements that should be complied with to be able to electronically transmit the mandate and the attached document(s).

The electronic status will be displayed at the end of the checklist. When the status is Eligible you can transmit the MR-69 form and attached documents.

For more information on the checklist, consult the help topic on the MR-69 form.

Important dates

- February 21, 2022 – Opening of the NetFile Québec system.

- February 21, 2022 – Opening of the Refund Info-line system.

- January 20, 2023 – Shut down of the NetFile Québec system.

NetFile Québec

- Tax preparers must register for “My Account for professional representatives” (available in French only), a secure space on RQ’s Web site, if they have not already done so in the past.

Note that renewal is automatic for persons who registered for this space in the past. - Consult the page “À qui s'adresse Mon dossier” (available in French only) to see which profile applies to you and what actions you can perform online on behalf of a business or an individual.

Calculations and Forms Not Available or Under Review

You can access the forms under review from the Form Manager. Although these forms are functional, they have not yet been updated for 2021. The following forms are presently under review for one of the following reasons: either the CRA has not yet released the final version, or we have received the form too late to integrate it.

The following forms are under review:

- Forms relating to mining exploration, resources and RS&ED tax credits

- Forms relating to provincial and territorial taxes for multiple jurisdictions situations

- T1206 and TP-766.3.4 – Tax on Split Income

- T5013 – Statement of Partnership Income

-

T1212-Statement of deferred security options benefits

-

Q1212-Statement of deferred security options benefits

Roll Forward

Rolling forward 2020 client files

Your 2020 client files must be rolled forward using the Roll Forward command on the File menu, or from the Client Manager, if you want to do a batch roll forward, before you can access them with this version.

Planner Files

You can import client files created in Planner Mode in version 2020.

Slips

The roll forward is performed only for copies of slips in which amounts were entered last year as well as for copies including balances to carry forward, or attached notes or schedules to roll forward.

Attached notes

The attached notes are rolled forward, except if this option is cleared in the roll forward data options.

Rolling Forward ProFile, DT Max and TaxCycle client files (competitor products)

Make sure that the workstation’s regional settings are set to “English (Canada or United-States)” before rolling forward.

Notes – Attached Notes Summary (Jump Code: ATTN)

Schedule – Attached Schedule with Total (Jump Code: ATTS)

When rolling forward client files, the attached notes or schedules attached to fields in the comparative summaries are retained.

Modifications Made to Version 1.0

Forms, Schedules and Workcharts Added to the Program

Ontario

ONS12, Ontario Seniors' Home Safety Tax Credit (Jump Code: ON S12)

A refundable credit, i.e., the Ontario seniors’ home safety tax credit, has been introduced for seniors and individuals who share a home with a senior relative. The refundable credit is equal to 25% of the eligible expenses. The credit amount is limited to $2,500.

Saskatchewan

SKS12, Saskatchewan Home Renovation Tax Credit (Jump Code: SK S12)

A non-refundable Saskatchewan home renovation tax credit has been introduced for 2021 and 2022 for owners of an eligible dwelling and can be allocated between members of a family. However, the total amount claimed cannot exceed the maximum authorized. For the 2021 taxation year, the qualified expenditures must be incurred between October 1, 2020, and December 31, 2021. The total qualified expenditures must be in excess of $1,000 (base amount) but cannot be more than $12,000 (maximum amount of $11,000 for 2021).

SK479, Saskatchewan Credit (Jump Code: SK 479)

This form allows taxpayers to claim the new active families benefit. This refundable tax credit has been introduced for families with children enrolled in sport, recreational and cultural activities. The maximum claimable amount per eligible child is $150. An additional amount of $50 can be claimed if the child is eligible for the disability tax credit.

Newfoundland and Labrador

NL479, Newfoundland and Labrador Credits (Jump Code: NL 479)

This form allows taxpayers to claim the new non-refundable physical activity tax credit, which has been introduced so that families can participate in physical and recreational activities. The maximum amount that can be claimed per family is $2,000.

The form also allows taxpayers to claim the Newfoundland and Labrador research and development tax credit for individuals, which was previously claimed on line 47900 of the T1 return.

Prince Edward Island

PE 58365, Children’s Wellness Tax Credit (Jump Code: PE 58365)

This worksheet allows taxpayers to claim this new non-refundable tax credit which has been introduced for all families with children under the age of 18, for eligible activities for the wellness of their children.

Modifications Made to Forms

ID, Identification and Other Client Information (Jump Code: ID)

The CCH Practice integration has been removed from the program. As a result, this integration option has been removed from the Options and Setting dialog box and the CCH Practice section in Form ID (Jump Code: ID) has also been removed.

If you would like to enter CCH Practice-related information in the client file, we suggest that you use one of the fields available in the program that will be retained when rolling forward the client file. For example, user-defined cells at the bottom of Form ID (Jump Code: ID).

Preparer Profiles and Forms T776, T1163, T1273, T2125, T2042, T2121, and T1135

The following changes have been made to the presentation and the processing of information on contact persons or the preparer based on the options selected in the PROFILE tab of the preparer profiles:

- The Accounting firm's name and address to print in the financial statements and the Notice to Reader section.

The selection of the Do you have a contact person? option on Forms T1163 and T1273 is now based on the choice made in the preparer profile for the option Use the accounting firm name and address for Forms T776, T2125, T2042, T2121, T1163 and T1273.

- Forms T2125, T2042 and T2121

In Part 1, the Name and address of person or firm preparing this form subsection is now available in the form on screen.

- Section Contact persons

The option Use the accounting firm address for Form T1135 has been added. It is selected by default for newly-created preparer profiles as well as for converted profiles. The choice made for this option will be retained at the time of conversion starting with version 2022 1.0.

Federal

Schedule 6 – Canada Workers Benefit – New secondary earner exemption (Jump Code: 6)

As a result of an update of the form, the secondary earner exemption has been introduced for the 2021 taxation year.

When the taxpayer who completed Schedule 6 to claim the Canada workers benefit has an eligible spouse, the income used to calculate the benefit is based on their combined income.

The secondary earner exemption is a special rule for taxpayers who have an eligible spouse. The spouse or common-law partner with the lowest working income can exclude up to $14,000 from his or her working income when computing the adjusted net income, allowing a greater number of families to have access the Canada workers benefit.

Schedule 14, Climate Action Incentive (Jump Code: 14)

The Government of Canada has announced that the Climate Action Incentive (CAI) will now be delivered as a quarterly benefit rather than as a refundable credit on the T1 Income Tax and Benefit Return. Eligible taxpayers will automatically receive CAI payments four times a year, starting in July 2022. To receive the payments, taxpayers must file a tax return even if they did not receive income in the year. For more information, go to canada.ca/child-family-benefits. The CAI consists of a basic amount and a 10% supplement for residents of small and rural communities. Schedule 14 should only be completed by taxpayers residing outside a census metropolitan area (CMA) and who expect to continue to reside outside the same CMA on April 1, 2022. To find out if the taxpayer resides outside a CMA, go to canada.ca/census-metropolitan-areas. As a result of these changes, line 45110 has been removed from the T1-Jacket.

The calculations for this new benefit will be updated in the next version, which is scheduled to be released in February 2022.

T4A slips – Addition of boxes (Jump Code: T4A)

Box 201

To help taxpayers get through the COVID-19 pandemic, the federal and provincial governments introduced various benefits. However, certain taxpayers had to repay part, or all of the COVID-19-related benefits received in 2020.

These repayments are entered in the T4A slip to which the following box has been added:

- Box 201, Repayment of COVID-19 financial assistance payments.

The repayment of federal benefits in 2021 should be updated to new line 23210, Federal COVID-19 benefits repayment of the T1 return.

The repayment of provincial or territorial benefits in 2021 should be updated to line 23200 of the T1 return.

To correctly identify the type of benefits repaid and, as a result, update the repaid amount to the corresponding line in the T1 return, the following custom boxes have been added to the T4A slip in the program:

- box 2011, Repayment of federal COVID-19 benefits received in 2020; and

- box 2012, Repayment of provincial or territorial COVID-19 benefits received in 2020.

Line 23210 of the T1 return

It is possible for taxpayers to have claimed a deduction for a repayment of federal COVID-19 benefits on their 2020 tax return (if the benefits were received in 2020 and repaid before 2023) prior to receiving their tax slip indicating the amount repaid. To ensure an amount repaid is not claimed as a deduction twice, a diagnostic has been added on line 23210 to make sure that the repayment of federal COVID-19 benefits entered on this line has not already been claimed on line 23200 of the taxpayer’s 2020 return. If this is the case, override the amount on line 23210 so that the amount already claimed is not taken into account.

Note: This diagnostic has been added as per a CRA request.

Box 205

In August 2021, the federal government provided financial support through a one-time taxable payment of $500 to seniors born on or before June 30, 1947, and eligible for Old Age Security in June 2021.

This payment amount is entered in the T4A slip to which the following box has been added:

- Box 205, One-time payment for older seniors.

This amount should be updated to line 13000.

Box 210

In its 2021 Budget, the federal government announced that the postdoctoral fellowship income would be considered income earned for the purposes of the registered retirement savings plan (RRSP).

Postdoctoral fellowship income (box 210 of the T4A slip) is included in earned income for purposes of a registered retirement savings plan (RRSP). This change allows postdoctoral fellows to qualify for supplemental RRSP contributions to make deductible contributions to an RRSP, a pooled registered pension plan (PRPP) or a specified pension plan (SPP). This measure is applicable retroactive to 2011. It is important to verify whether the taxpayer has reported postdoctoral fellowship income after 2010 and before 2021. Where applicable, the taxpayer can send an adjustment request to the CRA to have their RRSP contribution room adjusted.

This income is entered in the T4A slip to which the following box has been added:

- Box 210, Postdoctoral fellowship income earned.

You are not required to report this amount in the income tax return.

Box 211

To help taxpayers deal with the COVID-19 pandemic, the federal and provincial governments have introduced various benefits. The federal government proposes the new Canada Worker Lockdown Benefit. The latter provides an income support of $300 a week to eligible workers who, because of a temporary public health lockdown between October 24, 2021, and May 7, 2022, cannot work.

This benefit amount is entered in the new box 211 of the T4A slip:

- Box 211, Canada Worker Lockdown Benefit.

This amount must be updated to line 13000 of the T1 return.

T4E slip, Canada Emergency Response Benefit (CERB) (Jump Code: T4E)

Box 30

In response to the COVID-19 pandemic, the federal government introduced various benefits, one of which is the Canada Emergency Response Benefit (CERB). However, certain individuals had to repay part, or all of the CERB benefits received in 2020.

If the CERB was paid by the CRA, the repayment amount is indicated in box 201 of the T4A slip. On the other hand, if the benefit was paid by Service Canada, the repayment must be included with any other repayment in box 30 of the T4E slip. If this is the case, the CERB amount repaid will be indicated in a Service Canada letter sent to the taxpayer.

The 2021 repayment of federal benefits must be updated to line 23210, Repayment of COVID-19 financial assistance of the T1 return.

Finally, any other repayment included in box 30 must be updated to line 23200 of the T1 return.

To correctly identify the type of benefits repaid and, as a result, update the repaid amount to the corresponding line in the T1 return, box 30 has been split in two, and now corresponds to box 301, Repayment of an overpayment (excluding CERB) and box 302, Repayment of COVID-19 financial assistance (CERB). Note that the letter transmitted by Service Canada indicates the amount to enter in box 302.

T4RSP, Statement of RRSP Income – Addition of a box (Jump Code: T4RSP)

A box related to box 22 of the T4RSP slip has been added. This new box is used to enter the withdrawal amount of a tax-exempt RRSP for an Indian. The amount in this box will be updated for purposes of the federal return to Form T90 (Jump Code: 90) as well as for purposes of the Québec return to Form TP1 Line 293 (Jump Code: Q293).

T657, Calculation of Capital Gains Deduction (Jump Code: 657)

If you disposed of qualified farm or fishing property (QFFP) or qualified small business corporation shares (QSBCS) you may be eligible for the lifetime capital gains exemption (LCGE). Because you only include one half of a capital gain in your income, your cumulative capital gains deduction is one half of the LCGE.

The total of your capital gains deductions on gains arising from dispositions in 2021 of qualifying capital property has increased to $446,109 (i.e., one half of the LCGE increased by indexation to $892,218 for 2021).

For dispositions of QFFP after April 20, 2015, the LCGE is increased to $1,000,000. This additional deduction does not apply to dispositions of QSBCS:

- The limit on gains arising from dispositions in 2020 of qualifying capital property is $441,692 (one half of an LCGE of $883,384)

- The limit on gains arising from dispositions in 2019 of qualifying capital property is $433,456 (one half of an LCGE of $866,912)

- The limit on gains arising from dispositions in 2018 of qualifying capital property is $424,126 (one half of an LCGE of $848,252)

- The limit on gains arising from dispositions in 2017 of qualifying capital property is $417,858 (one half of an LCGE of $835,716)

- The limit on gains arising from dispositions in 2016 of qualifying capital property is $412,088 (one half of an LCGE of $824,176)

- The limit on gains arising from dispositions in 2015 of qualifying capital property is $406,800 (one half of an LCGE of $813,600)

- The limit on gains arising from dispositions in 2014 of qualifying capital property is $400,000 (one half of an LCGE of $800,000)

- The limit on gains arising from the dispositions of qualifying capital property after 2008 and before 2014 is $375,000 (one half of an LCGE of $750,000).

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates (Jump Code: 1134)

A new version of Form T1134 for taxation years starting after 2020 has been integrated into the program.

The new version of the form provides the ability, for a group of reporting entities that are related to each other, to file as a group. The information related to individuals, corporations, trusts and partnerships that are part of this related group must be indicated in new subsections A and B in Section 3 of Part I. Note that the taxation year-end date or fiscal year-end date must be the same for all entities in the group.

In the new subsection C in Section 3 of Part I (which corresponds to former Section 3 of Part 1), the question Is the reporting entity submitting a group organizational chart for the required information noted in C. (i) through (iv)? will allow you to submit an organizational chart if it contains the required information.

Several tables have been added to the form to allow for the filing of the return by a group of related entities. Therefore, entities in the group that are indicated in subsection A of Section 3 in Part I will be used to form a list from which you will be able to select the relevant entities in the tables of the T1134 Supplement section.

Québec

Tax measures announced in the November 25, 2021, Economic and Financial Update

On November 25, 2021, the Government of Québec introduced a number of tax measures.

Firstly, a one-time tax assistance has been introduced, i.e., the new one-time cost of living credit. Briefly, this assistance, of $200 per adult and an additional amount of $75 for persons living alone, is granted to individuals who are eligible for the refundable solidarity tax credit during the payment period starting on July 1, 2021, and ending on June 30, 2022, and will be paid automatically at the start of 2022.

As the payment will be made in January 2022 and this measure is automatically processed by the government, it will not be reflected in the program.

Secondly, starting with the 2022 taxation year, an individual (other than a trust) who provided childcare in Québec for compensation must now prepare an RL-24 slip and provide a copy to the payer. Therefore, receipts are no longer accepted as proof of payment for purposes of claiming the refundable tax credit for childcare expenses. This change has no impact on the program.

Finally, with regards to the refundable senior assistance tax credit and the refundable tax credit for childcare expenses, a number of rates and limits have been modified, and all required adjustments have been made to the program.

TP1, Income Tax Return – Incentive program to retain essential workers (IPREW) (Jump Code: TP1)

As a result of an update, line 151 of the TP1 return has been removed and the Incentive program to retain essential workers (IPREW) benefit amounts received will now be updated to Section 02 on the TP1 Line 154 form.

TP1 Line 246, Deduction for a Repayment of Amounts Overpaid to You (Jump Code: Q246)

To cope with the COVID-19 pandemic, the federal and provincial governments introduced various benefits. However, certain individuals had to repay part, or all benefits received in 2020 2020.

In this regard, Revenu Québec mentioned a repayment of the Québec Incentive program to retain essential workers (IPREW) made in 2021 could be deducted in the 2020 taxation year. However, the Canada Revenue Agency does not share this position.

As no lines have been created for that purpose in the TP1 return, a taxpayer who wants to deduct an IPREW amount received 2021 in the already filed 2020 income tax return, the taxpayer must file a Form TP-1.R (Jump Code: QTP1R) only. If the 2020 income tax return has not been filed, the line relating to the IPREW must be overridden in Form TP1 Line 246 (Jump Code: Q246) in order for the deduction to apply in Québec only. In addition, the taxpayer will have to claim the deduction for 2021 at the federal level only. Therefore, the line relating to the IPREW will need to be overridden in Form TP1 Line 246.

Schedule C, Tax Credit for Childcare Expenses (Jump Code: QC)

As a result of an update of the form by Revenu Québec, box 18, receiving Employment Insurance benefits or amounts for the Canada Recovery Benefit (CRB), Canada Recovery Sickness Benefit (CRSB) or Canada Recovery Caregiving Benefit (CRCB), has been added to the schedule.

RL-10 Slip, Decrease in the labour-sponsor tax credit - Fondaction (Jump Code: QR10)

On June 1, 2021, the provincial labour-sponsor tax credit for investments made in Fondaction decreased to 15%.

The investments made in Fondaction before June 1, 2021, give entitlement to a tax credit corresponding to 20% of the investment made during this period. Therefore, the maximum tax credit for investments made during this period is $1,000, for a maximum investment of $5,000.

The investments made starting on June 1, 2021, give entitlement to a maximum provincial tax credit of $750, for a maximum investment of $5,000.

Boxes have been added to the RL-10 slip to differentiate the periods during which the investments in Fondaction have been made.

RL-26 Slip, Capital régional et coopératif Desjardins (Jump Code: QR26)

The non-refundable tax credit rate for the acquisition of Class A shares of the Capital régional et coopératif Desjardins capital stock will be reduced from 35% to 30% for any Class A share acquired after February 28, 2021.

The tax credit rate for Class B shares will be maintained at 10%

CCA – Abolishment of the 35% and 60% additional deductions in Québec for property in classes 50 and 53

In the CCA CLASS forms of the T2125/TP80, T2042/Q2042 and T2121/Q2121 forms, the following additional deductions that could be claimed in Québec for property in classes 50 and 53 have been deleted:

- Additional CCA of 35%, for qualified property that was acquired and became available for use after March 28, 2017, and before March 28, 2018; and

- Additional CCA of 60%, for qualified property that was acquired and became available for use after March 27, 2018, and before December 4, 2018.

TP-1029.9, Tax Credit for Taxi Drivers or Taxi Owners (Jump Code: Q1029.9)

Tax credit for taxi drivers

The refundable tax credit for holders of a taxi driver’s permit will be phased out. Therefore, for 2021, taxpayers will be able to qualify for a credit equal to the lesser of the following amounts:

- 50% of the maximum amount that would otherwise have been applicable for the year, i.e., $301;

- 1% of the total of their gross income for the year arising from their employment as a taxi driver and their gross income for the year arising from their business of transportation services by taxi.

The tax credit will be abolished as of 2022.

Tax credit for taxi owners

The refundable tax credit for holders of a taxi owner’s permit will be abolished for a fiscal year or a taxation year starting after October 9, 2020.

Ontario

ON479, Ontario Credits (Jump Code: ON 479)

A refundable credit, i.e., the Ontario jobs training tax credit, has been introduced for eligible individuals. The credit is limited to $2,000.

A refundable tax credit, i.e., the Ontario seniors’ home safety tax credit, has been introduced.

Finally, the Ontario apprentice training tax credit has been eliminated.

ON479-A, Ontario Childcare Access and Relief from Expenses (CARE) Tax Credit (Jump Code: ON 479 A)

The credit entitlements for Ontario childcare access and relief from expenses (CARE) tax credit have increased by 20% for 2021 only.

Manitoba

MB428, Manitoba Tax (Jump Code: MB 428)

As a result of an update of the form, the personal income levels used to calculate the Manitoba tax and the basic personal amount have been increased. In addition, the maximum credit amount that can be claimed by an individual for the small business venture capital tax credit has increased from $67,500 to $120,000.

MB479, Manitoba Credits (Jump Code: MB 479)

As a result of an update of the form, changes have been made to the education property tax credit, seniors’ school tax rebate and school tax credit for homeowners. In particular, all three amounts have been reduced by 25% to consider the fact that property owners will now receive a cheque for the new Education Property Tax Rebate in the same month (or earlier) during which municipal property taxes are due. Property owners will not be required to apply for the rebate as the Education Property Tax Rebate will be automatically paid by the province of Manitoba.

In addition, a refundable teaching expense tax credit has been introduced for eligible educators. The credit equals 15% of eligible teaching expenses up to $1,000. The rules to claim this credit are the same as the federal educator school supply tax credit (line 46900) with the exception that supplies must have been used in Manitoba. A box has been added to Form T1 Line 46900 (Jump Code: 46900) to confirm that expenses entered for federal purposes were for supplies used in Manitoba.

New Brunswick

NB428, New Brunswick Tax and Credits (Jump Code: NB 428)

The Government of New Brunswick announced the following measures, which were integrated to the current version of the program:

- A reduction of the provincial personal income tax rate on the first tax bracket from 9.68 per cent to 9.4 per cent;

- An increase of the Low-Income Tax Reduction (LITR) threshold from $17,630 to $17,840 for the 2021 taxation year.

Newfoundland and Labrador

NL428, Newfoundland and Labrador Tax (Jump Code: NL 428)

Following the tabling of its March 31, 2021 Budget, the Government of Newfoundland and Labrador changed the personal income tax brackets and rates used to calculate the Newfoundland and Labrador income tax.

Note that most non-refundable provincial tax credits as well as the Newfoundland and Labrador income tax reduction for low-income families have also changed.

Prince Edward Island

PE428, Prince Edward Island Tax and Credits (Jump Code: PE 428)

Following its March 12, 2021 Budget, the Government of Prince Edward Island increased the basic personal amount from $10,000 to $10,500. The low-income threshold used to calculate the Prince Edward Island low-income tax reduction has also been increased.

In addition, the Prince Edward Island rate of the tax credit for dividends other that eligible dividends has been decreased from 2.74% to 1.96% on January 1, 2021.

Finally, the children's wellness tax credit has been added.

Forms Removed

Québec

- Schedule O, Tax credit for respite of caregivers

- Relevé 23, Recognition of volunteer respite services

Corrected Calculations

The following problems have been corrected in version 2021 1.0:

Federal

Technical Information

Technical Changes

Attach file

The Attached Files tab of the Properties dialog box now provides a link to open the new Attached Files dialog box. Note that the Attached Files tab will be removed from the properties box in a future version of Taxprep. You can also open the Attached Files dialog box from the File/ Attached Files menu or yet, by clicking the ![]() icon on the toolbar or by pressing the Ctrl+F11 hotkey.

icon on the toolbar or by pressing the Ctrl+F11 hotkey.

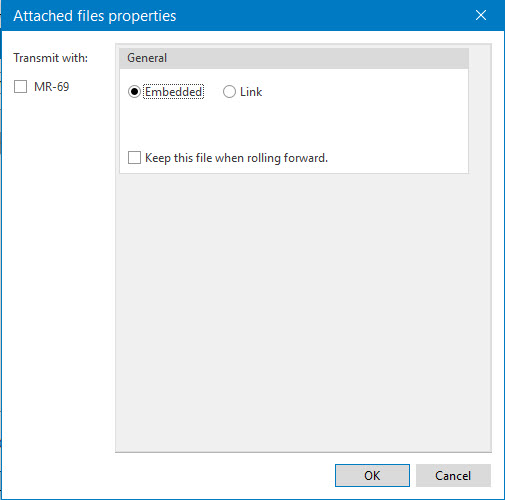

The new Attached Files dialog box includes a grid allowing you to display all files attached to the client file. The ![]() icon allows you to open the Attached files properties dialog box. In this box you will, among other things, be able to associate the attached file with the Québec MR-69 form and provide the required information to transmit the attachment with the MR-69 form, embed the attached file in the client file or link the former to the client file or determine the settings required to transmit a supporting document.

icon allows you to open the Attached files properties dialog box. In this box you will, among other things, be able to associate the attached file with the Québec MR-69 form and provide the required information to transmit the attachment with the MR-69 form, embed the attached file in the client file or link the former to the client file or determine the settings required to transmit a supporting document.

CCH Scan is currently not compatible with the option to link a file to the return. If you want to use CCH Scan and you want to attach a file to the return, make sure that you select the Embedded radio button.

Finally, the Attached Files section has been added to the Options and Settings. This section allows you to select the default method used to attach a file (embedded or linked).

For more information about attached files, consult the topic Attach file.

Electronic transmission of Form MR-69 and supporting documents accompanying the latter

Revenu Québec allows preparers to electronically transmit Form MR-69 as well as the supporting documents accompanying the latter.

Here are a few important points:

- The electronic transmission of MR-69 data must always be accompanied by a signed PDF copy of Form MR-69.

- Supporting documents (if any) must be combined into a single file that is separate from the signed PDF copy of Form MR-69.

- Only the following file types are accepted for the transmission of supporting documents: .pdf, .jpg and .tiff.

- The file size cannot exceed 25 MB.

- The file name cannot contain spaces nor any of the following characters:

- âêôûÄéÆÇàèÊùÌÍÎÏÐîÒÓÔÕÖ×ØÙÚÛÜÝÞßáãäåæçëìíïðñòóõö÷øúüýþÿ^~$°'|!#%&'`{}[]¤¨`:;,><@€£¬=²³?«»+ÀÁÂÃÅÈÉËÑ

Note: You can modify the syntax of the name of printed PDF files from Taxprep in the PDF Files pane of the Print section in the Options and Settings dialog box.

- âêôûÄéÆÇàèÊùÌÍÎÏÐîÒÓÔÕÖ×ØÙÚÛÜÝÞßáãäåæçëìíïðñòóõö÷øúüýþÿ^~$°'|!#%&'`{}[]¤¨`:;,><@€£¬=²³?«»+ÀÁÂÃÅÈÉËÑ

- You must enter your NetFile Québec credentials in the Québec tab of the Identification pane under the Electronic Services section of the Options and Settings dialog box.

The Attached files properties dialog box, which automatically displays when you attach a file, allows you to select the form to which you want to attach a supporting document. When you select option MR-69, you must select the type of document that you want to transmit, meaning the reason why the document is supporting the form. The Copies field allows you to select the copy of Form MR-69 with which you want to associate the attached document. Finally, the EFILE Status field allows you to follow up on the transmission of attached document.

To transmit Form MR-69 as well as the attached documents associated with it, click Authorization on the Transmission menu, and select the MR-69 dialog box in the Transmit – Authorization dialog box. In addition, if you do not want to transmit all eligible copies associated with Form MR-69, click the drop-down list in the Copies column, and clear the check box for the copies that you do not want to transmit.

When the EFILE status of Form MR-69 is Eligible, the box is automatically selected in the Transmit – Authorization dialog box.

For more information on the types of documents that can be transmitted, the EFILE statuses and the procedure to follow to transmit Form MR-69 with supporting documents, consult the Help.

Confidentiality of information

The Security pane has been added to the Print section of the Options and Settings dialog box. This pane contains two options allowing you to mask the first five digits of the social insurance number as well as in the header and footer of documents when printing a PDF or a hard copy of those documents. These options are also available in the Print Tax Returns and Print Form boxes. Note that these options are not selected by default.

AnswerConnect integration

AnswerConnect can now be used with the Taxprep InfoConnect feature. To that end, modifications have been made to the Options > Tax Research section of the Options and Settings. The IntelliConnect options subsection has been replaced by the Options related to the tax research platform subsection. In addition, the box Free trial as well as the IntelliConnect login information have been removed from this section.

To use AnswerConnect with the InfoConnect functionality, in the Options related to the tax research platform subsection, make sure that the check box Display InfoConnect is selected and select the AnswerConnect radio button. Note that the AnswerConnect option is selected by default.

Note that once this option is selected, a dialog box will be displayed when opening Taxprep to allow you to log in to AnswerConnect. In addition, if you close this box without entering the AnswerConnect login information, the option Show InfoConnect will be cleared in the Tax Research section of the Options and Settings.

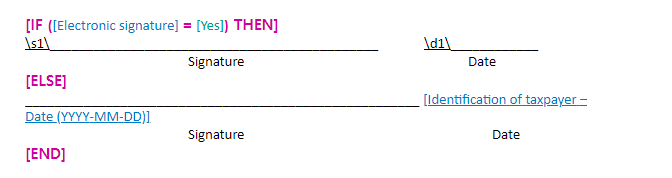

All custom letters are now supported for digital signature

Previously, only the Engagement letter was supported for digital signature. Now, all custom letters can be digitally signed. Customer letters do not have default e-tags integrated. To add an e-tag, you can copy digital signature tags from the Engagement letter and, where applicable, make the required adjustments. Here is the Digital Signature section in the Engagement letter:

Where:

\s1\ corresponds to the e-tag; and

\d1\ corresponds to the date of signature.

Where to Find Help

If you have any questions regarding the installation or use of the program, there are several options for getting help. Access the Professional Centre for tips and useful information on how to use the program. If you are in the program and need help, press F1 to get help on a specific topic.

In addition, our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

Videos available in the Professional Centre and on our Web site!

To learn more about Taxprep or to become familiar with the different features, consult the videos available in the Professional Centre.

Taxprep e-Bulletin

For your convenience, you are automatically subscribed to the Taxprep e-Bulletin, a free e-mail service that ensures you receive up-to-date information about the latest version of Personal Taxprep. If you want to review your subscription to Taxprep e-Bulletin, visit https://support.wolterskluwer.ca/en/support/ and, in the Newsletter section, click Subscription Manager. You can also send an e-mail to cservice@wolterskluwer.com to indicate the products for which you wish to receive general information or information on our CCH software (Personal Taxprep, Corporate Taxprep, Taxprep for Trusts, Taxprep Forms or CCH Accountants’ Suite).

How to Reach Us

Customer Service:

cservice@wolterskluwer.com

Tax and Technical support:

csupport@wolterskluwer.com

Telephone

1-800-268-4522